What we do

REAL PROPERTY TAX ANALYSIS AND DIRECT ASSESSMENTS CONSULTING

PROPERTY TAX REASSESSMENT SERVICES

West Coast Property Tax Appeal offers reassessment services for commercial, industrial, and residential properties that have seen a decline in market value or have been incorrectly assessed.

Our team of experts will work with the municipal body to correctly adjust the fair market value to a level that is in line with the current market conditions. Real estate in California is assessed in accordance with Proposition 13, which mandates that rate of the general levy be equal to assessed values be at 1% of a property’s market value and restricts the increase in assessments to 2% per year. When a property sells in an arms-length transaction, its purchase price is generally considered its market value, and the Assessor will usually use the price to determine the assessment.

When there is a decline in value, Proposition 8 allows the assessor to temporarily lower the assessed value of your property. Proposition 8 requires the Assessor to annually enroll the lesser of a property’s Proposition 13 value or its current value.

Proposition 8

Based Assessment Reductions Proposition 8 states that property owners are entitled to a temporary reduction in their property taxes if its current market value is less than its assessed value. Unfortunately, obtaining this temporary reduction can be a time consuming, arduous process. West Coast is equipped with the staff and tools to achieve the best results for property owners.

Proposition 13 Base Year Reductions

New Construction

New construction is generally assessable and may increase the taxable value of a property. The impact on a property tax assessment varies depending on the work being performed. Upon completion of the new construction, the assessor determines its fair market value, and a base year value is established.

Remodeling work is not generally subject to reassessment unless new square footage or fixtures are added. It can include new carpeting, countertops, cabinets, or windows. While remodeling work usually improves a building’s appearance, it does not change the effective age.

Under State law, your property tax may increase due to “New Construction” activity. In general, New Construction refers to any improvements other than normal maintenance or repair. When new construction is performed, the changed or new part of your home or commercial property may be reassessed at market value, thus increasing your property’s assessment.

Seniors, Disabled, Veteran, Disabled Veterans

Property tax relief is provided Seniors to transfer the trended value of a current property to a replacement home and for severely and permanently disabled claimants when they sell an existing home and buy or build another.

If you are a disabled veteran who is blind in both eyes, has lost the use of two or more limbs, or is totally disabled as a result of injury or disease incurred in military service, you may be eligible for a Disabled Veterans’ Property Tax Exemption.

Change of Ownership Issues

Change of Ownership issues are one of the most contested yet overlooked issued in property taxation. Every time title is transferred, it is subject to revaluation unless the proper exclusion or exemption is filed. Furthermore, legal entities are subject to revaluation whenever there are changes of control or even if there are simple transfers to children. West Coast is seasoned in representing taxpayers in ownership disputes where a new Proposition 13 value is established. We analyze the transaction to determine if there is exclusion or other means to mitigate the reassessment. If not, we actively represent our clients to obtain the lowest market value.

- Change of Ownership

- Sale or Transfer

- New Construction

- Construction Permit Applications

- Intra-family Transfers

Disaster Relief

You may be eligible for tax relief if your property is damaged or destroyed by a calamity, such as fire or flooding or the recent riots. A misfortune or calamity claim with the Assessor’s Office within 12 months from the date the property was damaged or destroyed. The loss must exceed $10,000 of current market value.

DIRECT ASSESSMENT CONSULTING

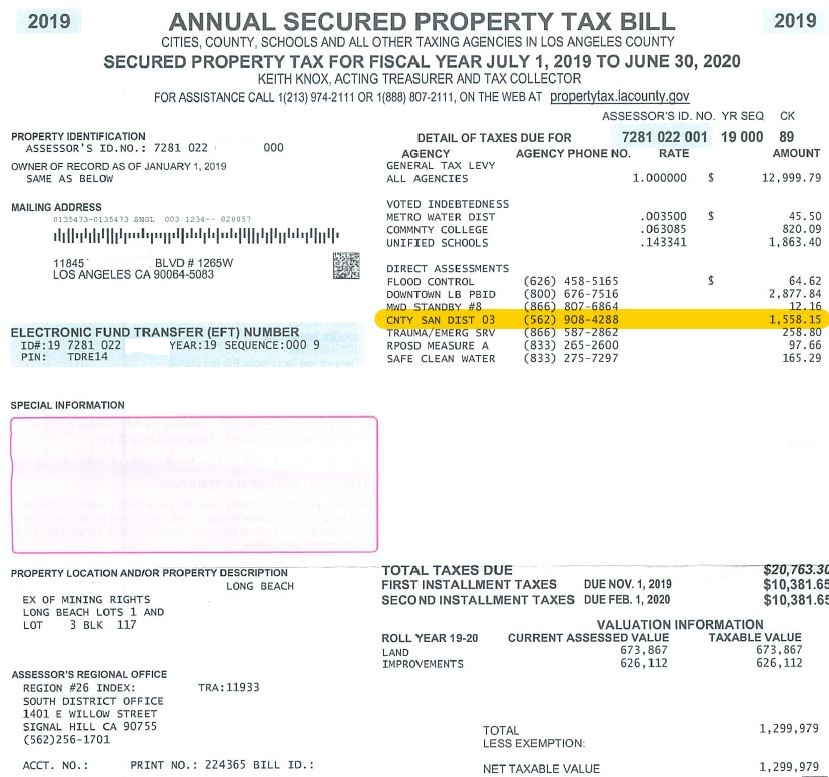

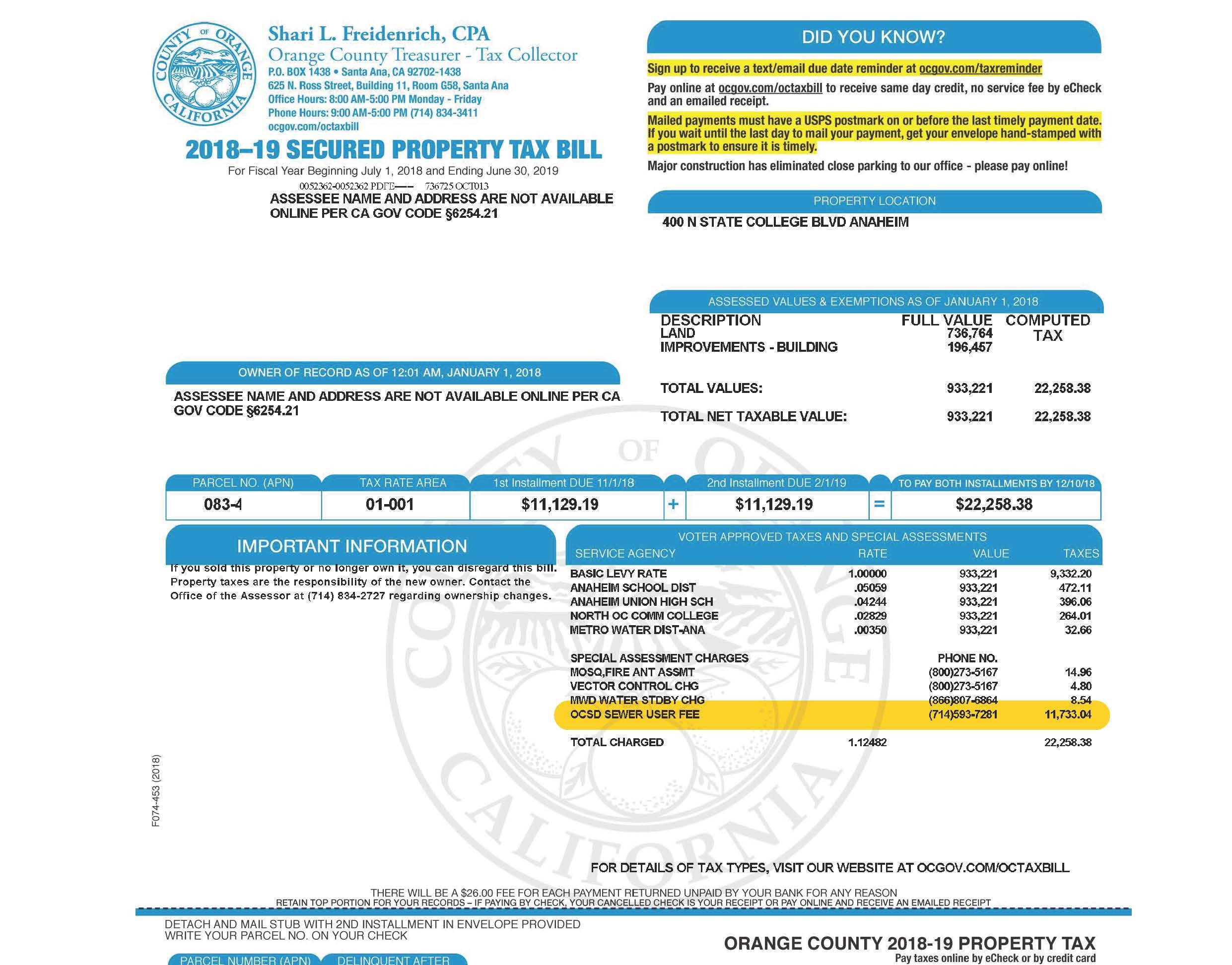

Real Property Taxes include more than the property’s general tax levy. Many bond items, city assessments and community service fees are tacked on to property tax bills, not all of which are related to the value of the property.

One of these Direct Assessments is the Sanitation Charge. Property owners are required to pay sewer user fees and charges on their annual property tax bills. The charges are used to pay for the operation and maintenance of the District’s wastewater management system. If your Sanitation Direct Assessment if greater than your actual water use, you may qualify for a reduction in your sanitation charge The Sanitation District charge is based upon average use of the sewerage system.

Property Tax Analysis

Types of Assessments and Filing Periods

Regular Assessments

Filing dates are July 2 to November 30*, of each year for all real and personal property assessments.

Supplemental Assessments

Filing dates are within 60 days of the mailing date printed on the Supplemental notice or tax bill, or the postmark date of the notice or tax bill, whichever is later.

Roll Change/Adjusted and Escape Assessments

Filing dates are within 60 days of the mailing date printed on the notice or adjusted/escape assessment tax bill, or the postmark date of the notice or tax bill, whichever is later.

Misfortune Calamity Reassessments

Filing dates are within six months after the mailing date of the proposed reassessment notice.

*Please Note: If the final filing date falls on a Saturday, Sunday, or a legal holiday, an application that is mailed and postmarked on the next business day shall be deemed to have been filed timely.